What is the current macroeconomic environment?

Global economic environment

- COVID-19 is in 216 countries/territories with 18,614,177 confirmed cases and 702,642 confirmed deaths (WHO, 7 August).

- To recap, the IMF has projected global growth at -4.9% in 2020 (IMF, 21 June).

- The OECD forecasts unemployment to reach nearly 10% in OECD countries by the end of 2020 with a job recovery not expected until after 2021 (OECD, 7 July).

- GDP in the US decreased by 9.5% in the second quarter compared with the first, the sharpest contraction for the US since official records began (BEA, 30 July).

- GDP decreased by 12.1% in the euro area and 11.9% in the EU in the second quarter compared with the previous quarter, the largest single quarter decline since the time series began (Eurostat, 31 July).

- China's GDP expanded 3.2% between April and June compared with a year earlier, with manufacturing output returning to pre-pandemic levels (AFR, 16 July).

- Interest rates: The Eurozone remains at 0%, China at 3.85%, Japan at -0.1%, the US at 0.25%, the UK at 0.1%.

Global assistance measures

Public health measures to suppress transmission such as testing, isolating, tracing and quarantining have prevented large-scale outbreaks and bought outbreaks under control in several countries. However, the pandemic continues to accelerate with total cases roughly doubling in the past 6 weeks (WHO, 27 July).

The WHO lists 25 COVID-19 candidate vaccines in clinical evaluation, with another 141 candidate vaccines in preclinical evaluation (WHO, 24 July).

The EU has agreed on a €750 billion post-pandemic recovery fund centred around €390 billion in grants to economically weakened member states (FT, 21 July).

Several countries are implementing or proposing green recovery measures. Germany has proposed a recovery budget that allocates €41 billion to areas like public transport, electric vehicles and renewable energy (Bloomberg, 5 June). South Korea has announced a USD 95 billion recovery plan with an emphasis on electric and hydrogen vehicle investments (Reuters, 14 July).

Several countries are also increasing R&D as part of their recovery. Supported by a record increase in public R&D funding, the UK has outlined a roadmap focussed on net zero emissions, climate change resilience and transformative technologies, among other areas (UK Government, 1 July). NZ has committed over NZD 400 million into R&D (NZ Herald, 5 June) and Singapore has committed over USD 14 billion into high impact innovation research (Bloomberg, 20 June).

To date, the IMF has distributed $25 billion in emergency financing to 72 countries and immediate debt relief to 29 countries (IMF, 23 July).

POLICY RESPONSES TO COVID-19 - Policy Tracker

Australian economic environment and assistance measures

19,862 confirmed cases and 255 confirmed deaths (Department of Health, 7 August).

State and territory governments continue to impose different restrictions with restrictions easing in many parts of the country since the National Cabinet announced a three-step plan on May 8 to relax restrictions. However, an ongoing COVID-19 outbreak in Victoria triggered Stage 4 restrictions for Metropolitan Melbourne and a ‘state of disaster’. Stage 3 and 2 restrictions have been applied to other parts of Victoria.

The Federal Government deficit reached $85.8 billion last financial year (4.3% of GDP), the largest since World War II. It is expected to reach more than $184.5 billion in 2020-21 (9.7% of GDP) (Treasurer, 24 July).

In June 2020, the official unemployment rate increased 0.4 percentage points (pts) to 7.4%. from May, an increase of 69,300 people. Full-time employment decreased 38,100 to around 8.5 million people and part-time employment increased 249,000 to over 3.8 million people. (ABS, 16 July).

The JobKeeper wage subsidy has been extended to March 2021 and a two-tiered will be introduced after September with the full rate falling from $1,500 to $1,200 a fortnight while people working fewer than 20 hours a week will receive $750 a fortnight. A further reduction to payment rates will be made at the beginning of January 2021 (Prime Minister, 21 July).

The Coronavirus Supplement for those on income support has been extended until the end of December 2020 and will fall from $550 to $250 a fortnight from 25 September onwards (Prime Minister, 21 July).

Along with existing assistance packages and JobMaker, the Federal Government has announced JobTrainer, a program focussed on training or re-skilling job seekers. JobTrainer will create 340,700 training places and cost $1 billion, with states and territories providing half the funding (Prime Minister, 16 July).

- The apprentices and trainee wage subsidy program has been increased by $1.5 billion, building on the initial $1.3 billion package (Prime Minister, 16 July).

- The interest rate remains at 0.25%.

How might macroeconomics impact the Australian energy sector?

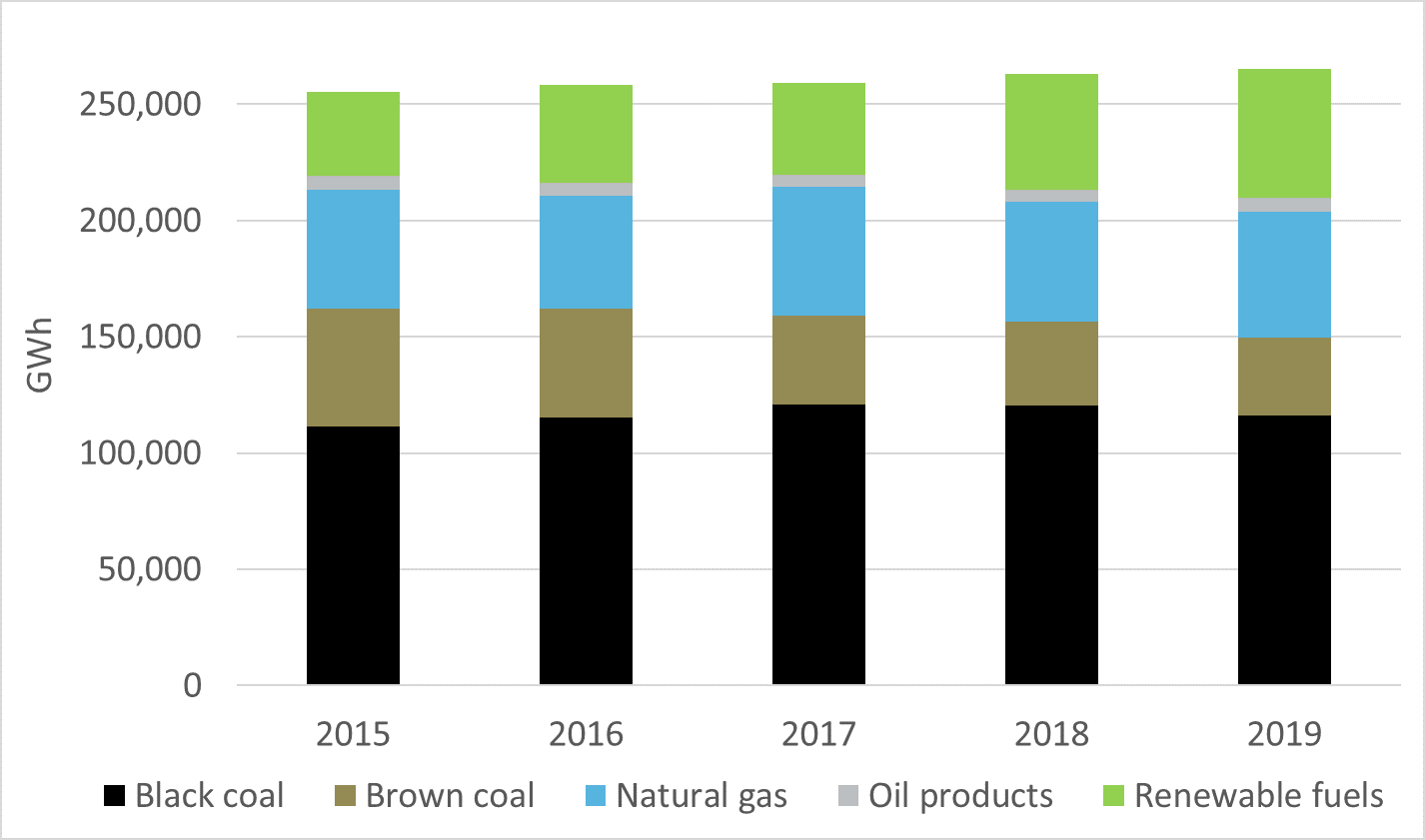

Total electricity generation in Australia was estimated to be 265,117 gigawatt hours (GWh) in 2019 and sourced from non-renewable coal (56%) and natural gas (21%), and renewable sources (wind, solar and hydro) (21%).

In 2017-18, gas accounted for 943 petajoules (PJ) or 22% of Australia’s total final energy consumption by fuel. Industries consumed over 793 PJ of natural gas, with manufacturing consuming 43% of this total.

Australia imports fuel from over 70 countries, with no individual country providing over 20% of total petroleum imports (both crude and refined products).

Expected and observed impacts on the sector

World energy demand is estimated to fall by 6% in 2020 relative to 2019. 8% of the 40 million jobs provided by the sector are at risk or have been lost (IEA, 1 June).

Global transport energy use has been greatly affected, with reduced mobility contributing to a 5% decrease in oil demand in the first quarter (IEA, 27 May).

According to the IEA, a 'Sustainable Recovery Plan' with significant global investment into renewable energy, clean transport, energy efficiency, fuel sustainability and innovation could generate 9 million new energy-related jobs and lead to global GDP being 3.5% higher than without a stimulus by 2023 (IEA, 1 June).

Despite the widespread impact of the pandemic, its effect on Australia's electricity demand in the second quarter of 2020 was modest, but lower oil and gas prices contributed to lower wholesale prices across the National Electricity Market (NEM) (DISER, 22 July).

The pandemic has intensified pressures in fossil fuel markets. In March 2020, international oil prices fell to their lowest levels since 2003 due the Saudi Arabia – Russia oil price war and COVID-19 related demand reductions. Domestically, falling demand led wholesale spot gas prices in first quarter 2020 to settle at their lowest quarterly levels in four years (AER, 1 July).

Wholesale electricity prices across the NEM fell by between 48% to 68% compared to the second quarter of 2019, reaching a 5-year low (DISER, 22 July).

Driven by fallen prices, energy exports were estimated at nearly $114.9 billion in 2019-20, a -13.5% change from 2018-19. Australian export earnings are forecast to fall to $86.7 billion in 2020-21 (OCE, 28 June).

- Thermal coal earnings are expected to fall by $4 billion to $16 billion in 2020-21 and the price of coal is likely to remain low for the rest of 2020 (OCE, 28 June).

- LNG prices, which were already on a downward cycle, have declined at a faster pace since the pandemic and Australia’s LNG exports earnings are forecast to fall by $14 billion to $34 billion in 2020–21 (OCE, 28 June).

- Oil prices are forecast to increase in the second half of 2020 but remain relatively low and Australian oil export earnings are estimated to decline from $9.0 billion in 2019–20 to $6.8 billion in 2020–21 (OCE, 28 June).

- Uranium prices have risen significantly since the start of the pandemic as a result of recent overseas production cuts and this is expected to push Australia’s uranium exports from $650 million in 2019–20 to $747 million by 2021–22 (OCE, 28 June).

Innovation in the energy sector

Despite a short-term demand plateau, growth will return as the recovery begins. Meeting global energy demand cleanly and cost-effectively offers Australia an opportunity to leverage its resources and capabilities to be a world-class energy and technology provider.

- Energy efficient technologies: Adopting high efficiency and electric technologies in buildings, industry and transport can greatly increase productivity. Increased energy efficiencies can reduce energy costs, emissions and demand on the grid, while also creating local jobs.

- Reliable and secure energy systems: As uptake of variable renewables increases, thorough grid planning and dynamic grid operation are required to maintain reliability and reduce costs throughout the transition.

- Remote area decarbonisation: Australia has many remote areas that are not grid connected and rely on diesel and gas imports. Transitioning these areas to renewable power and storage solutions could be accelerated, providing jobs and upskilling opportunities for locals and reducing reliance on fossil fuels. These solutions can be exported to neighbours with a high dependency on imported fuels.

- Hydrogen: Australia has an opportunity to develop the world’s first clean hydrogen energy export industry. As hydrogen production scales up locally, it can be used to decarbonise industries and reduce dependence on foreign energy imports. Access to low cost hydrogen can open industry opportunities like green steel and hydrogen technology manufacturing.

- Advanced solutions for industrial transition: Managing the environmental impact of industry generates opportunities to develop new technologies and reduce operating costs. Developments in energy efficiency, process productivity and energy optimisation can support this goal

Conclusion

In the short term, the focus is on slowing the spread of COVID-19 and economically protecting Australian households and businesses, while funding vaccine development and related science.

In the medium and long term, the focus should shift to how science, technology and innovation can lead the Australian economy’s recovery.

Disclaimer: This outlook contains general information only, and we are not, by means of this document, rendering professional advice or services. Before making any decision or taking any action that might affect your finances or business, you should consult a qualified professional advisor.

What is the current macroeconomic environment?

Global economic environment

- COVID-19 is in 216 countries/territories with 18,614,177 confirmed cases and 702,642 confirmed deaths (WHO, 7 August).

- To recap, the IMF has projected global growth at -4.9% in 2020 (IMF, 21 June).

- The OECD forecasts unemployment to reach nearly 10% in OECD countries by the end of 2020 with a job recovery not expected until after 2021 (OECD, 7 July).

- GDP in the US decreased by 9.5% in the second quarter compared with the first, the sharpest contraction for the US since official records began (BEA, 30 July).

- GDP decreased by 12.1% in the euro area and 11.9% in the EU in the second quarter compared with the previous quarter, the largest single quarter decline since the time series began (Eurostat, 31 July).

- China's GDP expanded 3.2% between April and June compared with a year earlier, with manufacturing output returning to pre-pandemic levels (AFR, 16 July).

- Interest rates: The Eurozone remains at 0%, China at 3.85%, Japan at -0.1%, the US at 0.25%, the UK at 0.1%.

Global assistance measures

Public health measures to suppress transmission such as testing, isolating, tracing and quarantining have prevented large-scale outbreaks and bought outbreaks under control in several countries. However, the pandemic continues to accelerate with total cases roughly doubling in the past 6 weeks (WHO, 27 July).

The WHO lists 25 COVID-19 candidate vaccines in clinical evaluation, with another 141 candidate vaccines in preclinical evaluation (WHO, 24 July).

The EU has agreed on a €750 billion post-pandemic recovery fund centred around €390 billion in grants to economically weakened member states (FT, 21 July).

Several countries are implementing or proposing green recovery measures. Germany has proposed a recovery budget that allocates €41 billion to areas like public transport, electric vehicles and renewable energy (Bloomberg, 5 June). South Korea has announced a USD 95 billion recovery plan with an emphasis on electric and hydrogen vehicle investments (Reuters, 14 July).

Several countries are also increasing R&D as part of their recovery. Supported by a record increase in public R&D funding, the UK has outlined a roadmap focussed on net zero emissions, climate change resilience and transformative technologies, among other areas (UK Government, 1 July). NZ has committed over NZD 400 million into R&D (NZ Herald, 5 June) and Singapore has committed over USD 14 billion into high impact innovation research (Bloomberg, 20 June).

To date, the IMF has distributed $25 billion in emergency financing to 72 countries and immediate debt relief to 29 countries (IMF, 23 July).

POLICY RESPONSES TO COVID-19 - Policy Tracker

Australian economic environment and assistance measures

19,862 confirmed cases and 255 confirmed deaths (Department of Health, 7 August).

State and territory governments continue to impose different restrictions with restrictions easing in many parts of the country since the National Cabinet announced a three-step plan on May 8 to relax restrictions. However, an ongoing COVID-19 outbreak in Victoria triggered Stage 4 restrictions for Metropolitan Melbourne and a ‘state of disaster’. Stage 3 and 2 restrictions have been applied to other parts of Victoria.

The Federal Government deficit reached $85.8 billion last financial year (4.3% of GDP), the largest since World War II. It is expected to reach more than $184.5 billion in 2020-21 (9.7% of GDP) (Treasurer, 24 July).

In June 2020, the official unemployment rate increased 0.4 percentage points (pts) to 7.4%. from May, an increase of 69,300 people. Full-time employment decreased 38,100 to around 8.5 million people and part-time employment increased 249,000 to over 3.8 million people. (ABS, 16 July).

The JobKeeper wage subsidy has been extended to March 2021 and a two-tiered will be introduced after September with the full rate falling from $1,500 to $1,200 a fortnight while people working fewer than 20 hours a week will receive $750 a fortnight. A further reduction to payment rates will be made at the beginning of January 2021 (Prime Minister, 21 July).

The Coronavirus Supplement for those on income support has been extended until the end of December 2020 and will fall from $550 to $250 a fortnight from 25 September onwards (Prime Minister, 21 July).

Along with existing assistance packages and JobMaker, the Federal Government has announced JobTrainer, a program focussed on training or re-skilling job seekers. JobTrainer will create 340,700 training places and cost $1 billion, with states and territories providing half the funding (Prime Minister, 16 July).

- The apprentices and trainee wage subsidy program has been increased by $1.5 billion, building on the initial $1.3 billion package (Prime Minister, 16 July).

- The interest rate remains at 0.25%.

How might macroeconomics impact the Australian energy sector?

Total electricity generation in Australia was estimated to be 265,117 gigawatt hours (GWh) in 2019 and sourced from non-renewable coal (56%) and natural gas (21%), and renewable sources (wind, solar and hydro) (21%).

In 2017-18, gas accounted for 943 petajoules (PJ) or 22% of Australia’s total final energy consumption by fuel. Industries consumed over 793 PJ of natural gas, with manufacturing consuming 43% of this total.

Australia imports fuel from over 70 countries, with no individual country providing over 20% of total petroleum imports (both crude and refined products).

Expected and observed impacts on the sector

World energy demand is estimated to fall by 6% in 2020 relative to 2019. 8% of the 40 million jobs provided by the sector are at risk or have been lost (IEA, 1 June).

Global transport energy use has been greatly affected, with reduced mobility contributing to a 5% decrease in oil demand in the first quarter (IEA, 27 May).

According to the IEA, a 'Sustainable Recovery Plan' with significant global investment into renewable energy, clean transport, energy efficiency, fuel sustainability and innovation could generate 9 million new energy-related jobs and lead to global GDP being 3.5% higher than without a stimulus by 2023 (IEA, 1 June).

Despite the widespread impact of the pandemic, its effect on Australia's electricity demand in the second quarter of 2020 was modest, but lower oil and gas prices contributed to lower wholesale prices across the National Electricity Market (NEM) (DISER, 22 July).

The pandemic has intensified pressures in fossil fuel markets. In March 2020, international oil prices fell to their lowest levels since 2003 due the Saudi Arabia – Russia oil price war and COVID-19 related demand reductions. Domestically, falling demand led wholesale spot gas prices in first quarter 2020 to settle at their lowest quarterly levels in four years (AER, 1 July).

Wholesale electricity prices across the NEM fell by between 48% to 68% compared to the second quarter of 2019, reaching a 5-year low (DISER, 22 July).

Driven by fallen prices, energy exports were estimated at nearly $114.9 billion in 2019-20, a -13.5% change from 2018-19. Australian export earnings are forecast to fall to $86.7 billion in 2020-21 (OCE, 28 June).

- Thermal coal earnings are expected to fall by $4 billion to $16 billion in 2020-21 and the price of coal is likely to remain low for the rest of 2020 (OCE, 28 June).

- LNG prices, which were already on a downward cycle, have declined at a faster pace since the pandemic and Australia’s LNG exports earnings are forecast to fall by $14 billion to $34 billion in 2020–21 (OCE, 28 June).

- Oil prices are forecast to increase in the second half of 2020 but remain relatively low and Australian oil export earnings are estimated to decline from $9.0 billion in 2019–20 to $6.8 billion in 2020–21 (OCE, 28 June).

- Uranium prices have risen significantly since the start of the pandemic as a result of recent overseas production cuts and this is expected to push Australia’s uranium exports from $650 million in 2019–20 to $747 million by 2021–22 (OCE, 28 June).

Innovation in the energy sector

Despite a short-term demand plateau, growth will return as the recovery begins. Meeting global energy demand cleanly and cost-effectively offers Australia an opportunity to leverage its resources and capabilities to be a world-class energy and technology provider.

- Energy efficient technologies: Adopting high efficiency and electric technologies in buildings, industry and transport can greatly increase productivity. Increased energy efficiencies can reduce energy costs, emissions and demand on the grid, while also creating local jobs.

- Reliable and secure energy systems: As uptake of variable renewables increases, thorough grid planning and dynamic grid operation are required to maintain reliability and reduce costs throughout the transition.

- Remote area decarbonisation: Australia has many remote areas that are not grid connected and rely on diesel and gas imports. Transitioning these areas to renewable power and storage solutions could be accelerated, providing jobs and upskilling opportunities for locals and reducing reliance on fossil fuels. These solutions can be exported to neighbours with a high dependency on imported fuels.

- Hydrogen: Australia has an opportunity to develop the world’s first clean hydrogen energy export industry. As hydrogen production scales up locally, it can be used to decarbonise industries and reduce dependence on foreign energy imports. Access to low cost hydrogen can open industry opportunities like green steel and hydrogen technology manufacturing.

- Advanced solutions for industrial transition: Managing the environmental impact of industry generates opportunities to develop new technologies and reduce operating costs. Developments in energy efficiency, process productivity and energy optimisation can support this goal

Conclusion

In the short term, the focus is on slowing the spread of COVID-19 and economically protecting Australian households and businesses, while funding vaccine development and related science.

In the medium and long term, the focus should shift to how science, technology and innovation can lead the Australian economy’s recovery.

For further information

Disclaimer: This outlook contains general information only, and we are not, by means of this document, rendering professional advice or services. Before making any decision or taking any action that might affect your finances or business, you should consult a qualified professional advisor.