What is the current macroeconomic environment?

Global economic environment

- The end of June marks six months since the WHO first received reports of cases out of China. COVID-19 is in 216 countries/territories with 10,533,779 confirmed cases and 512,842 confirmed deaths (WHO, 3 July).

- A deeper downturn than previously projected is expected for several economies. In its latest World Economic Outlook forecast, the IMF projected global growth at -4.9 percent in 2020, 1.9 percentage points below their April 2020 forecast. Household consumption, firm investment, and service output have dropped significantly, and this loss of economic activity has severely impacted labour markets (IMF, 21 June).

- Forecasts from the ILO indicate that the decline in working hours in the global labour market for the second quarter of 2020, relative to the last quarter of 2019, will be equivalent to 305 million full-time jobs (ILO, 27 May).

- Updated first quarter results: The economy contracted by 3.8% in the Eurozone and 3.5% in the EU (ECB, 30 April [pdf · 185kb]), the US economy contracted by 5.0% (BEA, 25 June) and the Chinese economy by 6.8% (Business Insider, 17 April).

- Interest rates: The Eurozone remains at 0%, China at 3.85%, Japan at -0.1%, the US at 0.25%, and the UK at 0.1%.

Global assistance measures

- Many countries have implemented unprecedented measures in suppressing transmission and major investments are being made into accelerating vaccine development, diagnostics, and therapeutics. Nevertheless, some countries are experiencing a resurgence of cases after easing restrictions and globally the pandemic is accelerating (WHO, 29 June).

- Global financial conditions have eased, in part due to unprecedented intervention by central banks, and governments around the world have provided emergency fiscal policy measures amounting to nearly $11 trillion (IMF, 25 June [pdf · 332kb]). For a comprehensive and current policy response tracker, see IMF, 26 June.

- To date, the IMF has distributed around $25 billion in emergency financing assistance to 70 countries (IMF, 18 June).

Australian economic environment and assistance measures

- 7,920 confirmed cases and 104 confirmed deaths (Department of Health, 2 July).

- Testing remains high, with more than 2.2 million tests undertaken, and the Australian Government remains committed to the 3-Step Framework for easing restrictions (National Cabinet Statement, 26 June). State and territory governments continue to impose different restrictions depending on their circumstances.

- To recap, the Australian economy contracted by 0.3% in first quarter of 2020 (ABS, 3 June).

- The first quarter saw average household net worth decreasing 2.3%, or $9,982 per person, which was the largest decrease since 2011. Much of this was caused by losses in Australian and international financial markets due to COVID-19. Similarly, total superannuation assets fell 9.2% at the end of the March quarter, a slightly larger decline than during the height of the GFC in 2008 (ABS, 25 June). In May 2020, the unemployment rate increased by 0.7 percentage points (pts) to 7.1%. Between March and April, employment decreased by 227,700 people, with full-time employment and part-time employment decreasing by 220,500 and 373,800 people respectively. The underemployment rate decreased by 0.7 pts to 13.1% (ABS, 18 June).

- Along with the existing staged assistance packages, the Federal Government has outlined a JobMaker plan which includes fast-tracking 15 large-scale infrastructure projects, $1.5 billion to smaller infrastructure projects, a business deregulation and industrial relations reform agenda, and changes to the workforce skills sector (ABC News, 15 June).

- The Australian interest rate remains at 0.25% since the rate reductions in March.

How might macroeconomics impact the Australian mining and minerals sector?

Mining accounted for 8.7% of GDP in 2019 and employed approximately 243,000 people as at February 2020 (OCE, 28 June).

In 2018, Australia was the largest global producer of bauxite, iron ore, and lithium. It was also the second largest producer of gold, lead, and rare earths; and the third largest producer of cobalt, diamond, and zinc (Geosciences Australia, 2020 [pdf · 13mb]).

Anticipated and observed impacts on the mining and minerals sector

- Mining activity is expected to be moderately affected by the pandemic, with reduced global economic growth and disrupted industrial production causing falls in export demand and revenue (IbisWorld, 17 June).

- Globally, the top 40 mining companies are forecast to experience a 6% reduction in EBITDA, driven largely by fallen commodity prices, and a capital spend reduction of 20% that is expected to recover after 2020 (PwC, June [pdf · 6.5mb]).

- Overall, the mineral resources sector continues to operate strongly, particularly in Australia, through the pandemic. Record levels of government and central bank stimulus that aim to boost activity and investment around the world are expected to lead to new projects that drive demand in minerals (AFR, 2 July).

- Investment is expected to continue to recover in 2020 and 2021 after falls between 2014 and 2019 due to the end of the infrastructure boom and the completion of several large LNG projects (ABC News, 28 June).

- ABS data shows mineral exploration expenditure by private organisations fell 0.6% (-$4.3 million) to $712.7 million in the first quarter of 2020 (ABS, 2 June).

- A survey by the Association of Mining and Exploration Companies (AMEC) indicates that, as of April, 74% of exploration companies had ceased all or most exploration operations as they struggle to attract investment. This comes off the back of a very weak investment environment for exploration over the past 18-24 months (AMEC, 6 May [pdf · 3.5mb]).

- A survey of global resource industry leaders indicates that 68% of Australian respondents have experienced a ‘strong’ or ‘significant’ business impact from COVID-19 as of April, with the most common being revenue loss (55%), business model disruption (45%), frustrated contracts (33%) and loss of profits (30%) (VCI, May [pdf · 6.6mb]).

- The value of Australian resource exports for the 2019-20 financial year is estimated at a record high of $178 billion thanks to China’s infrastructure drive and a weaker Australian dollar. However, export earnings are forecast to fall to $177 billion in 2020-21 and $160 billion in 2021-22, with lower commodity prices offsetting expected growth in export volumes. This is only a modest fall though, with earnings almost 50% higher in real terms than during the GFC (OCE, 28 June).

- Resource export volumes rose by 4.6% over the year since June 2019 and are forecast to show modest growth over the next two years (OCE, 28 June).

- Iron ore prices have recovered from falls in the first four months of 2020, partly due to supply disruptions in Brazil and robust Chinese demand. Growing supply is expected to reduce the ore price over the next two years, with exports forecast to fall from $103 billion in 2019-20 to $81 billion in 2021-22 (OCE, 28 June).

- Export earnings from aluminium, alumina and bauxite are projected to decline due to slowing demand and increasing supply. Lithium and zinc export earnings are expected to fall over the next year. In contrast, gold exports are forecast to reach a record $32 billion in 2020-21 due to its rising demand as a safe asset. Copper and nickel earnings are forecast to steadily rise over the next two years as a result of recovering prices and expanding domestic production (OCE, 28 June).

Science and technology innovation in the sector

While the Australian minerals sector continues to be dependent on world commodity markets of which we have very little influence, we can leverage science and technology to unlock value-adding growth opportunities and support economic recovery and resilience.

- Exploration technology: As exploration funding recovers, translation of new technologies from the science into industry applications can provide a competitive advantage for Australia (as per the UNCOVER initiative).

- Orebody knowledge: Advanced sensing and characterisation techniques, in combination with next generation data and digital technologies, will enable improved decision making, increased yield and throughput, and improved environmental and social performance.

- Selective extraction: Targeted and localised ore extraction technologies that reject non-valuable material earlier in the process will improve preconcentration, reduce processing costs, and eliminate or reduce the movement of waste leading to improved environmental, financial, productivity and safety outcomes.

- Critical minerals: The Australian Government drive for security of critical mineral supply [pdf · 3.5mb], for sovereign risk and diverse global supply chains together with international partners, sees a new focus on value added refining to manufacturing opportunities in the critical mineral resource market.

- Demand management: Integrating and optimising existing and emerging renewable energy generation and storage technologies, along with process re-engineering, to maximise site energy requirements and take advantage of excess renewables will improve productivity and reduce emissions and operation costs.

Conclusion

1. In the short term, the focus is on slowing the spread of COVID-19 and economically protecting Australian households and businesses, while funding vaccine development and related science.

2. In the long term, focus should shift to how science, technology and innovation can lead the Australian economy’s recovery.

Disclaimer: This document contains general information only, and we are not, by means of this document, rendering professional advice or services. Before making any decision or taking any action that might affect your finances or business, you should consult a qualified professional advisor.

What is the current macroeconomic environment?

Global economic environment

- The end of June marks six months since the WHO first received reports of cases out of China. COVID-19 is in 216 countries/territories with 10,533,779 confirmed cases and 512,842 confirmed deaths (WHO, 3 July).

- A deeper downturn than previously projected is expected for several economies. In its latest World Economic Outlook forecast, the IMF projected global growth at -4.9 percent in 2020, 1.9 percentage points below their April 2020 forecast. Household consumption, firm investment, and service output have dropped significantly, and this loss of economic activity has severely impacted labour markets (IMF, 21 June).

- Forecasts from the ILO indicate that the decline in working hours in the global labour market for the second quarter of 2020, relative to the last quarter of 2019, will be equivalent to 305 million full-time jobs (ILO, 27 May).

- Updated first quarter results: The economy contracted by 3.8% in the Eurozone and 3.5% in the EU (ECB, 30 April [pdf · 185kb]), the US economy contracted by 5.0% (BEA, 25 June) and the Chinese economy by 6.8% (Business Insider, 17 April).

- Interest rates: The Eurozone remains at 0%, China at 3.85%, Japan at -0.1%, the US at 0.25%, and the UK at 0.1%.

Global assistance measures

- Many countries have implemented unprecedented measures in suppressing transmission and major investments are being made into accelerating vaccine development, diagnostics, and therapeutics. Nevertheless, some countries are experiencing a resurgence of cases after easing restrictions and globally the pandemic is accelerating (WHO, 29 June).

- Global financial conditions have eased, in part due to unprecedented intervention by central banks, and governments around the world have provided emergency fiscal policy measures amounting to nearly $11 trillion (IMF, 25 June [pdf · 332kb]). For a comprehensive and current policy response tracker, see IMF, 26 June.

- To date, the IMF has distributed around $25 billion in emergency financing assistance to 70 countries (IMF, 18 June).

Australian economic environment and assistance measures

- 7,920 confirmed cases and 104 confirmed deaths (Department of Health, 2 July).

- Testing remains high, with more than 2.2 million tests undertaken, and the Australian Government remains committed to the 3-Step Framework for easing restrictions (National Cabinet Statement, 26 June). State and territory governments continue to impose different restrictions depending on their circumstances.

- To recap, the Australian economy contracted by 0.3% in first quarter of 2020 (ABS, 3 June).

- The first quarter saw average household net worth decreasing 2.3%, or $9,982 per person, which was the largest decrease since 2011. Much of this was caused by losses in Australian and international financial markets due to COVID-19. Similarly, total superannuation assets fell 9.2% at the end of the March quarter, a slightly larger decline than during the height of the GFC in 2008 (ABS, 25 June). In May 2020, the unemployment rate increased by 0.7 percentage points (pts) to 7.1%. Between March and April, employment decreased by 227,700 people, with full-time employment and part-time employment decreasing by 220,500 and 373,800 people respectively. The underemployment rate decreased by 0.7 pts to 13.1% (ABS, 18 June).

- Along with the existing staged assistance packages, the Federal Government has outlined a JobMaker plan which includes fast-tracking 15 large-scale infrastructure projects, $1.5 billion to smaller infrastructure projects, a business deregulation and industrial relations reform agenda, and changes to the workforce skills sector (ABC News, 15 June).

- The Australian interest rate remains at 0.25% since the rate reductions in March.

How might macroeconomics impact the Australian mining and minerals sector?

Mining accounted for 8.7% of GDP in 2019 and employed approximately 243,000 people as at February 2020 (OCE, 28 June).

In 2018, Australia was the largest global producer of bauxite, iron ore, and lithium. It was also the second largest producer of gold, lead, and rare earths; and the third largest producer of cobalt, diamond, and zinc (Geosciences Australia, 2020 [pdf · 13mb]).

Anticipated and observed impacts on the mining and minerals sector

- Mining activity is expected to be moderately affected by the pandemic, with reduced global economic growth and disrupted industrial production causing falls in export demand and revenue (IbisWorld, 17 June).

- Globally, the top 40 mining companies are forecast to experience a 6% reduction in EBITDA, driven largely by fallen commodity prices, and a capital spend reduction of 20% that is expected to recover after 2020 (PwC, June [pdf · 6.5mb]).

- Overall, the mineral resources sector continues to operate strongly, particularly in Australia, through the pandemic. Record levels of government and central bank stimulus that aim to boost activity and investment around the world are expected to lead to new projects that drive demand in minerals (AFR, 2 July).

- Investment is expected to continue to recover in 2020 and 2021 after falls between 2014 and 2019 due to the end of the infrastructure boom and the completion of several large LNG projects (ABC News, 28 June).

- ABS data shows mineral exploration expenditure by private organisations fell 0.6% (-$4.3 million) to $712.7 million in the first quarter of 2020 (ABS, 2 June).

- A survey by the Association of Mining and Exploration Companies (AMEC) indicates that, as of April, 74% of exploration companies had ceased all or most exploration operations as they struggle to attract investment. This comes off the back of a very weak investment environment for exploration over the past 18-24 months (AMEC, 6 May [pdf · 3.5mb]).

- A survey of global resource industry leaders indicates that 68% of Australian respondents have experienced a ‘strong’ or ‘significant’ business impact from COVID-19 as of April, with the most common being revenue loss (55%), business model disruption (45%), frustrated contracts (33%) and loss of profits (30%) (VCI, May [pdf · 6.6mb]).

- The value of Australian resource exports for the 2019-20 financial year is estimated at a record high of $178 billion thanks to China’s infrastructure drive and a weaker Australian dollar. However, export earnings are forecast to fall to $177 billion in 2020-21 and $160 billion in 2021-22, with lower commodity prices offsetting expected growth in export volumes. This is only a modest fall though, with earnings almost 50% higher in real terms than during the GFC (OCE, 28 June).

- Resource export volumes rose by 4.6% over the year since June 2019 and are forecast to show modest growth over the next two years (OCE, 28 June).

- Iron ore prices have recovered from falls in the first four months of 2020, partly due to supply disruptions in Brazil and robust Chinese demand. Growing supply is expected to reduce the ore price over the next two years, with exports forecast to fall from $103 billion in 2019-20 to $81 billion in 2021-22 (OCE, 28 June).

- Export earnings from aluminium, alumina and bauxite are projected to decline due to slowing demand and increasing supply. Lithium and zinc export earnings are expected to fall over the next year. In contrast, gold exports are forecast to reach a record $32 billion in 2020-21 due to its rising demand as a safe asset. Copper and nickel earnings are forecast to steadily rise over the next two years as a result of recovering prices and expanding domestic production (OCE, 28 June).

Science and technology innovation in the sector

While the Australian minerals sector continues to be dependent on world commodity markets of which we have very little influence, we can leverage science and technology to unlock value-adding growth opportunities and support economic recovery and resilience.

- Exploration technology: As exploration funding recovers, translation of new technologies from the science into industry applications can provide a competitive advantage for Australia (as per the UNCOVER initiative).

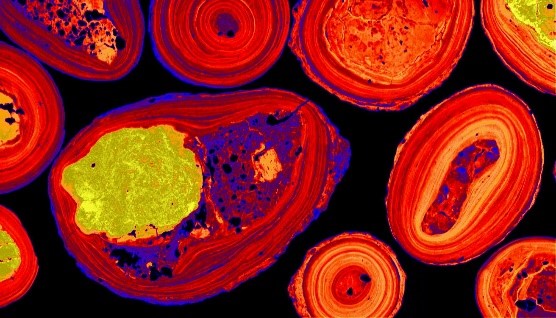

Advanced mineral characterisation techniques will enable improved decision making. - Orebody knowledge: Advanced sensing and characterisation techniques, in combination with next generation data and digital technologies, will enable improved decision making, increased yield and throughput, and improved environmental and social performance.

- Selective extraction: Targeted and localised ore extraction technologies that reject non-valuable material earlier in the process will improve preconcentration, reduce processing costs, and eliminate or reduce the movement of waste leading to improved environmental, financial, productivity and safety outcomes.

- Critical minerals: The Australian Government drive for security of critical mineral supply [pdf · 3.5mb], for sovereign risk and diverse global supply chains together with international partners, sees a new focus on value added refining to manufacturing opportunities in the critical mineral resource market.

- Demand management: Integrating and optimising existing and emerging renewable energy generation and storage technologies, along with process re-engineering, to maximise site energy requirements and take advantage of excess renewables will improve productivity and reduce emissions and operation costs.

Conclusion

1. In the short term, the focus is on slowing the spread of COVID-19 and economically protecting Australian households and businesses, while funding vaccine development and related science.

2. In the long term, focus should shift to how science, technology and innovation can lead the Australian economy’s recovery.

Disclaimer: This document contains general information only, and we are not, by means of this document, rendering professional advice or services. Before making any decision or taking any action that might affect your finances or business, you should consult a qualified professional advisor.