What is the current macroeconomic environment?

Global economic environment

- COVID-19 is in 235 countries/territories with 36,002,827 confirmed cases and 1,049,810 confirmed deaths (WHO, 9 October).

- The OCED estimates that global GDP will decline by 4.5% this year, before picking up by 5% in 2021. This drop is smaller than projected by the OCED's June projections when a 6% decline world economic activity was forecast as a possibility, though the outlook remains uncertain. All G20 countries, except for China, will have had recessions in 2020 (OECD, 16 September).

- Global foreign direct investment flows forecast to fall by up to 40% in 2020 (UNCTAD, 16 June).

- Interest rates: The Eurozone remains at 0%, China at 3.85%, Japan at -0.1%, the US at 0.25%, the UK at 0.1%.

Global assistance measures

- While some countries responded quickly and avoided large outbreaks, and other countries were able to bring outbreaks under control and continue to suppress the virus, there are still countries that are in the intense phase of transmission, as well as those that have experienced an increase in cases when restrictions were eased (WHO, 2 October).

- "Green recovery" measures, such as grants, loans and tax reliefs directed towards green transport, circular economy and clean energy research, development and deployment, have so far amounted to USD 312 billion globally (OECD, 14 September).

- The WHO lists 42 COVID-19 candidate vaccines in clinical evaluation, with another 151 candidate vaccines in preclinical evaluation (WHO, 2 October).

- For a globally comprehensive and current policy response tracker, see IMF, 9 October.

Australian economic environment and assistance measures

- 27,206 confirmed cases and 897 confirmed deaths (Department of Health, 9 October).

- To recap, GDP fell 7.0% in the June quarter, after a fall of 0.3% in the March quarter 2020 (ABS, 2 September).

- State and territory governments continue to impose different restrictions. In Victoria, a roadmap for reopening has been announced after a COVID-19 outbreak in the state triggered heightened restrictions.

- From July to August, the official unemployment rate decreased by 0.7 percentage points to 6.8%. In seasonally adjusted employment terms, employment increased by 111,000 people (ABS, 17 September).

- Considering those who have lost employment, left the labour force or have experienced zero working hours, the effective unemployment rate is around 9.3% (Treasurer, 17 September).

- The Australian interest rate remains at 0.25%.

The 2020-21 Federal Budget was released this week. Key points from the Budget:

- Net debt is estimated to reach $703 billion this year and peak at $966 billion by June 2024. However, due to historically low interest rates, Australia's debt servicing cost is expected to be 0.7% of GDP in 2020-21 and fall to 0.6% in 2022-23 and 2023-24, so the debt burden is likely to remain manageable.

- Income tax cuts scheduled for 2022 have been brought forward and backdated to July this year.

- Businesses with a turnover of up to $5 billion will be able to claim a full value write-off on eligible assets.

- Eligible employers will receive a hiring credit of $200 a week for hiring workers on JobSeeker and aged 16-30, and $100 a week for those aged 30-35.

- In terms of innovation-related items, an additional $2 billion is being invested into the Research and Development Tax Incentive, a reversal on proposed cuts to the scheme.

- $1 billion will be provided for the university sector to address the impact of COVID-19 on research activities. This includes $5.8 million to a scoping study to accelerate the translation and commercialisation of research. An additional $459.2 million will be provided to CSIRO to address the impact of COVID-19 on its commercial activities.

- The Budget will also provide $36.3 million to support the Great Barrier Reef Restoration and Adaption Program, $8.9 million for the Humanities, Arts, Social Sciences and Indigenous e-research platforms, $8.3 million for new synthetic biology research infrastructure to respond to emerging disease and biosecurity risks, and $7.6 million to upgrade the ACCESS climate and earth system model.

- The Budget also expands on the Government's earlier announcement of $1.5 billion to support the Modern Manufacturing Strategy within six National Manufacturing Priorities (minerals and resources, food and beverage, medical, recycling and energy, defence and space) and its $1.9 billion investment package in future technologies to lower emissions. This includes piloting carbon capture projects, setting up a hydrogen export hub, and backing new microgrids in regional and remote areas

How might macroeconomics impact Australia's digital capabilities?

In 2019, the digital sector – comprising information, media and telecommunications, and computer system design and related services – was estimated to contribute $122 billion in Gross Value Added (6.6% of GDP) to the economy and the broader tech sector was estimated to employ over 580,000 workers.

Expected and observed impacts on the capabilities

In terms of the Federal Budget:

- $796.5 million is being invested in a range of digital adoption focussed activities for businesses.

- This includes $19.2 million to build small business digital capabilities, $3.0 million to develop a Digital Readiness Assessment tool to help businesses, $11.4 million for a Regtech Commercialisation Initiative, and $6.9 million for blockchain pilots aimed at reducing business compliance costs.

- This also includes a further $256.6 million to expand the use and application of digital identity systems and $419.9 million to bring together and modernise government business registers.

- Other digital measures include $222.2 million to modernise ICT systems and business processes for agricultural exporters, as well as $52.8 million to expand the Manufacturing Modernisation Fund.

Other observed impacts on digital capabilities:

- COVID-19 has led to a historic transformation in areas such as telehealth and online education, and substantial deployment of digital technologies around the world. One study indicates that, across several major economies, five years' worth of consumer and business digital adoption occurred in eight weeks around April of this year (McKinsey, 14 May).

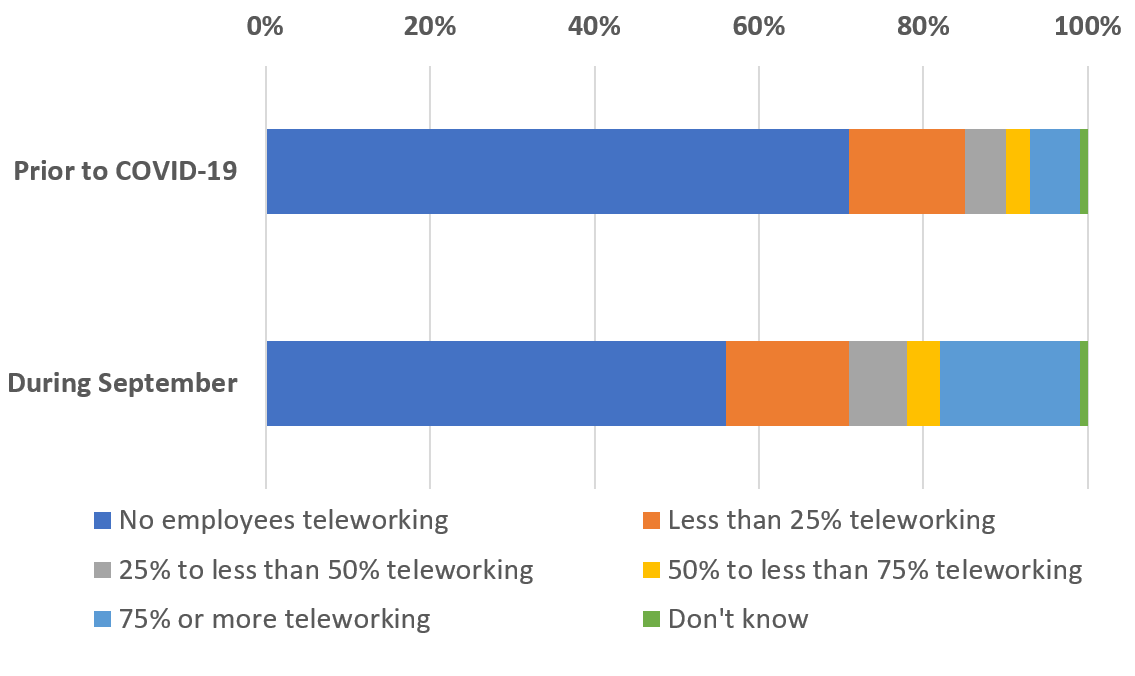

- Hundreds of thousands of Australian businesses moved their work online. More than two in five employing businesses (43%) reported having staff teleworking, compared to 28% of businesses before COVID-19. Large businesses are twice as likely to have staff teleworking compared to small businesses (ABS, 24 September).

- Moreover, recent business survey data suggests that around three in ten businesses expect staff to continue to telework once restrictions are lifted and conditions stabilise (ABS, 24 September).

Figure 1.1: Businesses, by the proportion of workforce teleworking

- According to NBN Co, network demand increased by approximately 25% due to the outbreak of COVID-19 (IBISWorld). A $4.5 billion network investment plan was announced, aiming to give up to 75% of fixed-line premises in regional and metropolitan Australia access to ultra-fast broadband by 2023 (Minister for Communications, Cyber Safety and the Arts, 23 September).

- In terms of consumer behaviour, total online sales represented 9.7% of total sales in July. While this is a fall from the peak of 11.3% in April 2020, the proportion of online sales in July remains higher than pre-COVID-19 levels and has remained largely steady since May 2020 (ABS, 4 September).

- The Government has announced it will invest $1.67 billion over ten years into a new Cyber Security Strategy. The Strategy notes how the pandemic has bought attention to cyber criminals taking advantage of the crisis to conduct widespread email and SMS phishing campaigns. It also notes how Australian organisations have been targeted in recent months by state-based cyber actors (Australia's Cyber Security Strategy 2020).

Innovation in digital capabilities

In CSIRO's recently released COVID-19: Recovery and resilience report, digital is considered both a vertical sector in its own right and a horizontal sector that underpins and strengthens other sectors. For example, there are opportunities for system-wide integration of digital technologies in the health sector, for digitisation of the value chain in the food and agriculture sector, and for increased automation in the mineral resource sector.

For the digital sector itself, the following opportunities can drive economic recovery and resilience:

- Data utilisation: Businesses can better leverage technologies to utilise and monetise data they already collect. This can help inform decision making, improve processes, drive new efficiencies and increase safety. With increased data utilisation comes a heightened need for cyber security measures.

- Data proliferation and sharing: New data can also be collected from operations and equipment and this can be shared throughout the supply chain, including with customers and competitors. Likewise, this comes with an increased need for cyber security.

- Risk management and business continuity: Risk‑based assessment technologies can increase operational understanding and improve risk recognition and mitigation. Scenario planning and modelling can assist businesses to understand risks and plan contingencies. These technologies can also be used more broadly – e.g. in disaster resilience modelling.

- Automated systems and workplace distribution: There is still scope to automate routine and some non-routine tasks. This can free up capital and resources to reinvest in growth, as well as create complementary jobs in automation design and development, data analysis, monitoring and evaluation. This will require an understanding of how AI can be best applied and the development of ethical safeguards resources.

- Quantum technology: The emerging quantum technology industry could help future‑proof the digital sector, enhance productivity and unlock new capabilities such as in early disease detection, material science, defence applications and ore discovery. Although its benefits are longer‑term, investments now can prepare Australia to compete globally.

For a full list of opportunities for economic recovery, see CSIRO's COVID-19: Recovery and resilience report.

Conclusion

- In the medium term, the focus should be on supporting the recovery of core industries with deployment-ready technologies, including through improved health and safety measures, digitalisation, and other economic growth opportunities.

- In the long term, the focus should shift to how science, technology and innovation can build a resilient economy and reduce the economy’s exposure to future disruptions.

Disclaimer: This document contains general information only, and we are not, by means of this document, rendering professional advice or services. Before making any decision or taking any action that might affect your finances or business, you should consult a qualified professional advisor.

What is the current macroeconomic environment?

Global economic environment

- COVID-19 is in 235 countries/territories with 36,002,827 confirmed cases and 1,049,810 confirmed deaths (WHO, 9 October).

- The OCED estimates that global GDP will decline by 4.5% this year, before picking up by 5% in 2021. This drop is smaller than projected by the OCED's June projections when a 6% decline world economic activity was forecast as a possibility, though the outlook remains uncertain. All G20 countries, except for China, will have had recessions in 2020 (OECD, 16 September).

- Global foreign direct investment flows forecast to fall by up to 40% in 2020 (UNCTAD, 16 June).

- Interest rates: The Eurozone remains at 0%, China at 3.85%, Japan at -0.1%, the US at 0.25%, the UK at 0.1%.

Global assistance measures

- While some countries responded quickly and avoided large outbreaks, and other countries were able to bring outbreaks under control and continue to suppress the virus, there are still countries that are in the intense phase of transmission, as well as those that have experienced an increase in cases when restrictions were eased (WHO, 2 October).

- "Green recovery" measures, such as grants, loans and tax reliefs directed towards green transport, circular economy and clean energy research, development and deployment, have so far amounted to USD 312 billion globally (OECD, 14 September).

- The WHO lists 42 COVID-19 candidate vaccines in clinical evaluation, with another 151 candidate vaccines in preclinical evaluation (WHO, 2 October).

- For a globally comprehensive and current policy response tracker, see IMF, 9 October.

Australian economic environment and assistance measures

- 27,206 confirmed cases and 897 confirmed deaths (Department of Health, 9 October).

- To recap, GDP fell 7.0% in the June quarter, after a fall of 0.3% in the March quarter 2020 (ABS, 2 September).

- State and territory governments continue to impose different restrictions. In Victoria, a roadmap for reopening has been announced after a COVID-19 outbreak in the state triggered heightened restrictions.

- From July to August, the official unemployment rate decreased by 0.7 percentage points to 6.8%. In seasonally adjusted employment terms, employment increased by 111,000 people (ABS, 17 September).

- Considering those who have lost employment, left the labour force or have experienced zero working hours, the effective unemployment rate is around 9.3% (Treasurer, 17 September).

- The Australian interest rate remains at 0.25%.

The 2020-21 Federal Budget was released this week. Key points from the Budget:

- Net debt is estimated to reach $703 billion this year and peak at $966 billion by June 2024. However, due to historically low interest rates, Australia's debt servicing cost is expected to be 0.7% of GDP in 2020-21 and fall to 0.6% in 2022-23 and 2023-24, so the debt burden is likely to remain manageable.

- Income tax cuts scheduled for 2022 have been brought forward and backdated to July this year.

- Businesses with a turnover of up to $5 billion will be able to claim a full value write-off on eligible assets.

- Eligible employers will receive a hiring credit of $200 a week for hiring workers on JobSeeker and aged 16-30, and $100 a week for those aged 30-35.

- In terms of innovation-related items, an additional $2 billion is being invested into the Research and Development Tax Incentive, a reversal on proposed cuts to the scheme.

- $1 billion will be provided for the university sector to address the impact of COVID-19 on research activities. This includes $5.8 million to a scoping study to accelerate the translation and commercialisation of research. An additional $459.2 million will be provided to CSIRO to address the impact of COVID-19 on its commercial activities.

- The Budget will also provide $36.3 million to support the Great Barrier Reef Restoration and Adaption Program, $8.9 million for the Humanities, Arts, Social Sciences and Indigenous e-research platforms, $8.3 million for new synthetic biology research infrastructure to respond to emerging disease and biosecurity risks, and $7.6 million to upgrade the ACCESS climate and earth system model.

- The Budget also expands on the Government's earlier announcement of $1.5 billion to support the Modern Manufacturing Strategy within six National Manufacturing Priorities (minerals and resources, food and beverage, medical, recycling and energy, defence and space) and its $1.9 billion investment package in future technologies to lower emissions. This includes piloting carbon capture projects, setting up a hydrogen export hub, and backing new microgrids in regional and remote areas

How might macroeconomics impact Australia's digital capabilities?

In 2019, the digital sector – comprising information, media and telecommunications, and computer system design and related services – was estimated to contribute $122 billion in Gross Value Added (6.6% of GDP) to the economy and the broader tech sector was estimated to employ over 580,000 workers.

Expected and observed impacts on the capabilities

In terms of the Federal Budget:

- $796.5 million is being invested in a range of digital adoption focussed activities for businesses.

- This includes $19.2 million to build small business digital capabilities, $3.0 million to develop a Digital Readiness Assessment tool to help businesses, $11.4 million for a Regtech Commercialisation Initiative, and $6.9 million for blockchain pilots aimed at reducing business compliance costs.

- This also includes a further $256.6 million to expand the use and application of digital identity systems and $419.9 million to bring together and modernise government business registers.

- Other digital measures include $222.2 million to modernise ICT systems and business processes for agricultural exporters, as well as $52.8 million to expand the Manufacturing Modernisation Fund.

Other observed impacts on digital capabilities:

- COVID-19 has led to a historic transformation in areas such as telehealth and online education, and substantial deployment of digital technologies around the world. One study indicates that, across several major economies, five years' worth of consumer and business digital adoption occurred in eight weeks around April of this year (McKinsey, 14 May).

- Hundreds of thousands of Australian businesses moved their work online. More than two in five employing businesses (43%) reported having staff teleworking, compared to 28% of businesses before COVID-19. Large businesses are twice as likely to have staff teleworking compared to small businesses (ABS, 24 September).

- Moreover, recent business survey data suggests that around three in ten businesses expect staff to continue to telework once restrictions are lifted and conditions stabilise (ABS, 24 September).

Figure 1.1: Businesses, by the proportion of workforce teleworking

- According to NBN Co, network demand increased by approximately 25% due to the outbreak of COVID-19 (IBISWorld). A $4.5 billion network investment plan was announced, aiming to give up to 75% of fixed-line premises in regional and metropolitan Australia access to ultra-fast broadband by 2023 (Minister for Communications, Cyber Safety and the Arts, 23 September).

- In terms of consumer behaviour, total online sales represented 9.7% of total sales in July. While this is a fall from the peak of 11.3% in April 2020, the proportion of online sales in July remains higher than pre-COVID-19 levels and has remained largely steady since May 2020 (ABS, 4 September).

- The Government has announced it will invest $1.67 billion over ten years into a new Cyber Security Strategy. The Strategy notes how the pandemic has bought attention to cyber criminals taking advantage of the crisis to conduct widespread email and SMS phishing campaigns. It also notes how Australian organisations have been targeted in recent months by state-based cyber actors (Australia's Cyber Security Strategy 2020).

Innovation in digital capabilities

In CSIRO's recently released COVID-19: Recovery and resilience report, digital is considered both a vertical sector in its own right and a horizontal sector that underpins and strengthens other sectors. For example, there are opportunities for system-wide integration of digital technologies in the health sector, for digitisation of the value chain in the food and agriculture sector, and for increased automation in the mineral resource sector.

For the digital sector itself, the following opportunities can drive economic recovery and resilience:

- Data utilisation: Businesses can better leverage technologies to utilise and monetise data they already collect. This can help inform decision making, improve processes, drive new efficiencies and increase safety. With increased data utilisation comes a heightened need for cyber security measures.

- Data proliferation and sharing: New data can also be collected from operations and equipment and this can be shared throughout the supply chain, including with customers and competitors. Likewise, this comes with an increased need for cyber security.

- Risk management and business continuity: Risk‑based assessment technologies can increase operational understanding and improve risk recognition and mitigation. Scenario planning and modelling can assist businesses to understand risks and plan contingencies. These technologies can also be used more broadly – e.g. in disaster resilience modelling.

- Automated systems and workplace distribution: There is still scope to automate routine and some non-routine tasks. This can free up capital and resources to reinvest in growth, as well as create complementary jobs in automation design and development, data analysis, monitoring and evaluation. This will require an understanding of how AI can be best applied and the development of ethical safeguards resources.

- Quantum technology: The emerging quantum technology industry could help future‑proof the digital sector, enhance productivity and unlock new capabilities such as in early disease detection, material science, defence applications and ore discovery. Although its benefits are longer‑term, investments now can prepare Australia to compete globally.

For a full list of opportunities for economic recovery, see CSIRO's COVID-19: Recovery and resilience report.

Conclusion

- In the medium term, the focus should be on supporting the recovery of core industries with deployment-ready technologies, including through improved health and safety measures, digitalisation, and other economic growth opportunities.

- In the long term, the focus should shift to how science, technology and innovation can build a resilient economy and reduce the economy’s exposure to future disruptions.

For further information

Disclaimer: This document contains general information only, and we are not, by means of this document, rendering professional advice or services. Before making any decision or taking any action that might affect your finances or business, you should consult a qualified professional advisor.