Positioning Australia for an additional $13 billion protein opportunity

With an expected two billion extra people on the planet to feed by 2050, coupled with changing tastes and dietary preferences, there is a growing demand around the world for more protein, produced more sustainably and from a wider variety sources.

Developed with government and industry, the ‘Protein: A roadmap for unlocking technology-led growth opportunities for Australia’ released in March 2022 identifies a $13 billion market opportunity for Australia to grow and diversify its high-quality protein products from various different sources.

Australia: a global leader in high quality, value-added protein

Australia has traditionally been a strong exporter of bulk protein commodities, exporting about 70 per cent of what it produces – like grains, legumes and meat – however there is great opportunity to value-add to many of these products.

This can be achieved by both growing established products and markets, as well as developing new differentiated protein products.

This Roadmap identifies five strategic science and technology focus areas as well as five priorities to better guide industry activities, which will enable Australia to position itself as a global leader in this space.

Key to this strategy are ten growth opportunities that combine animal, plant and non-traditional protein production systems listed below:

- integrity systems in the red meat sector to help verify the origin of production, support compliance, prevent risks and support research

- expanding Australian red meat exports into new geographic markets

- plant-based protein ingredients

- crop-breeding and pre-breeding

- turning lesser cuts of red meat into value-added protein powders and nutraceuticals

- insect protein sources for food and feed

- creating a new sustainable Australian white-flesh fish industry

- new plant-based products

- precision fermentation

- cultivated meats.

Read the report

- Australia's National Protein Roadmap Executive Summary

- Australia's Protein Roadmap Exec Summary

- Australia's Protein Roadmap

- Australia's Protein Roadmap

Notes

- OECD (2021) OECD Agriculture Statistics. Viewed 11 January 2021, Covers beef and veal, pork, poultry, sheep and fish.

- See Appendix B protein snapshots.

- Counted as businesses with one or more employees operating in livestock farming, fisheries and aquaculture, hunting and trapping, meat and seafood

product processing and manufacturing, and dairy product processing and manufacturing. ABS (2021) Counts of Australian Businesses, including Entries and Exits. Viewed 11 January 2022 - Counted as 'sheep, beef cattle and grain', 'dairy cattle', 'poultry', 'other livestock', 'aquaculture', 'fishing' and 'hunting and trapping' industries. Australian Bureau of Agricultural and Resource Economics and Sciences (2020) Agricultural commodities and trade data - Australian economy - farm sector.

- Australian Bureau of Agricultural and Resource Economics and Sciences (2021) Agricultural commodities June quarter 2021: Value of agricultural,

fisheries and forestry exports (fob), Australia. - Food Frontier (2021) 2020 State of the Industry Australia’s Plant-Based Meat Sector.

Find out more

Want to learn more about Australia’s opportunities to become a global leader of protein production? Talk to CSIRO Futures about how we can help.

- Read the blog article: Australian roadmap to serve up future protein

- Read the media release: Roadmap to put uniquely Australian protein on the global menu

This report is part of CSIRO’s Future Protein Mission and was developed in consultation with key stakeholders in government, industry and the research sector across Australia’s agriculture and food system.

Positioning Australia for an additional $13 billion protein opportunity

With an expected two billion extra people on the planet to feed by 2050, coupled with changing tastes and dietary preferences, there is a growing demand around the world for more protein, produced more sustainably and from a wider variety sources.

Developed with government and industry, the ‘Protein: A roadmap for unlocking technology-led growth opportunities for Australia’ released in March 2022 identifies a $13 billion market opportunity for Australia to grow and diversify its high-quality protein products from various different sources.

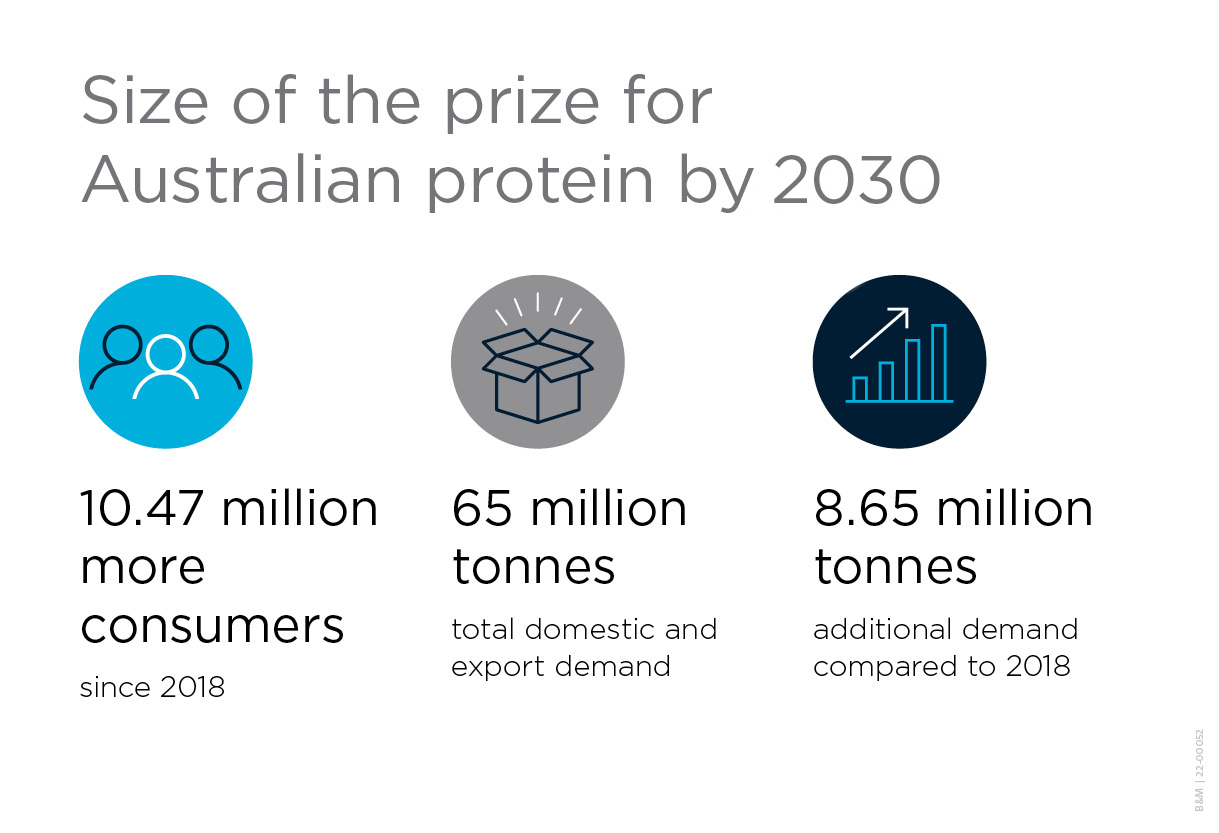

Size of the prize for Australian protein by 2030

0.47 million more consumers since 2018

65 million tonnes total domestic and export demand

8.65 million tonnes additional demand compared to 2018

Source: Agrifutures

Australia: a global leader in high quality, value-added protein

Australia has traditionally been a strong exporter of bulk protein commodities, exporting about 70 per cent of what it produces – like grains, legumes and meat – however there is great opportunity to value-add to many of these products.

This can be achieved by both growing established products and markets, as well as developing new differentiated protein products.

This Roadmap identifies five strategic science and technology focus areas as well as five priorities to better guide industry activities, which will enable Australia to position itself as a global leader in this space.

Key to this strategy are ten growth opportunities that combine animal, plant and non-traditional protein production systems listed below:

- integrity systems in the red meat sector to help verify the origin of production, support compliance, prevent risks and support research

- expanding Australian red meat exports into new geographic markets

- plant-based protein ingredients

- crop-breeding and pre-breeding

- turning lesser cuts of red meat into value-added protein powders and nutraceuticals

- insect protein sources for food and feed

- creating a new sustainable Australian white-flesh fish industry

- new plant-based products

- precision fermentation

- cultivated meats.

Read the report

- Australia's National Protein Roadmap Executive Summary PDF (2 MB)

- Australia's Protein Roadmap Exec Summary TXT (21 KB)

- Australia's Protein Roadmap PDF (7 MB)

- Australia's Protein Roadmap TXT (371 KB)

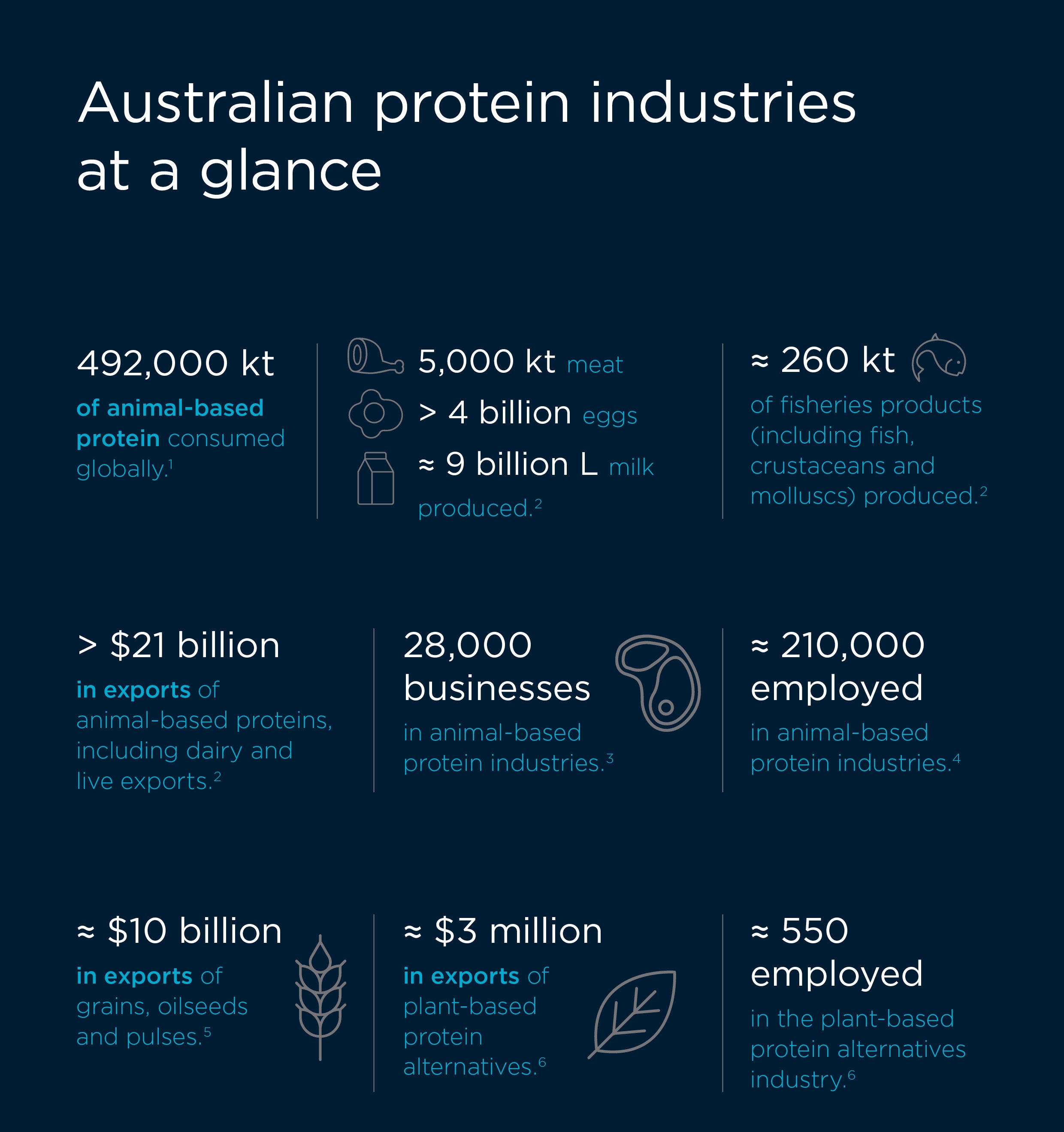

Australian protein industries at a glance

492,000 kt of animal-based protein consumed globally.

5,000 kt meat

> 4 billion eggs

Approximately 9 billion L milk produced

Approximately 260 kt of fisheries products (including fish, crustaceans and molluscs) produced in Australia.

> $21 billion in exports of Australian animal-based proteins, including dairy and live exports.

28,000 businesses in Australian animal-based protein industries

Approximately 210,000 employed in Australian animal-based protein industries.

Approximately $10 billion in exports of grains, oilseeds and pulses

Approximately $3 million in exports of plant-based protein alternatives

Approximately 550 employed in the Australian plant-based protein alternatives industry.

Notes

- OECD (2021) OECD Agriculture Statistics. Viewed 11 January 2021, Covers beef and veal, pork, poultry, sheep and fish.

- See Appendix B protein snapshots.

- Counted as businesses with one or more employees operating in livestock farming, fisheries and aquaculture, hunting and trapping, meat and seafood

product processing and manufacturing, and dairy product processing and manufacturing. ABS (2021) Counts of Australian Businesses, including Entries and Exits. Viewed 11 January 2022 - Counted as 'sheep, beef cattle and grain', 'dairy cattle', 'poultry', 'other livestock', 'aquaculture', 'fishing' and 'hunting and trapping' industries. Australian Bureau of Agricultural and Resource Economics and Sciences (2020) Agricultural commodities and trade data - Australian economy - farm sector.

- Australian Bureau of Agricultural and Resource Economics and Sciences (2021) Agricultural commodities June quarter 2021: Value of agricultural,

fisheries and forestry exports (fob), Australia. - Food Frontier (2021) 2020 State of the Industry Australia’s Plant-Based Meat Sector.

Find out more

Want to learn more about Australia’s opportunities to become a global leader of protein production? Talk to CSIRO Futures about how we can help.

- Read the blog article: Australian roadmap to serve up future protein

- Read the media release: Roadmap to put uniquely Australian protein on the global menu

This report is part of CSIRO’s Future Protein Mission and was developed in consultation with key stakeholders in government, industry and the research sector across Australia’s agriculture and food system.